🚪 The Door for a Rate Cut in May is now Open

After inflation came in lighter than forecasted, a hint of rate cuts, and some promising retail sales data, the FTSE 100 rallied 204 points and is now in touching distance of the magical 8,000 mark.

Hello there! I'm John Choong, Senior Equity Research Analyst at InvestingReviews. Every weekend, I bring a different and unique perspective to the week’s biggest’s macroeconomic data and stories, and what it means for your investments.

🗞️ This Week’s Biggest Headlines

🧯 Inflation is getting extinguished: February CPI came in softer than forecast, dropping to 3.4% from 4.0%, with core also down to 4.5% from 5.1%. On a 3, 6, and 9-month annualised basis, both headline and core are now sub-2%.

🕊️ Bank of England finally gets dovish: The BoE might’ve held the Bank Rate at 5.25%, but there are now indications that rate cuts might come sooner than the market is expecting after two MPC members stopped voting to hike rates.

💪🏻 The great British consumer: Atrocious weather in February didn’t do retail sales volumes estimates any favours. Economists were expecting a dull -0.3% print — only for the headline print to surprise, as volumes remained resilient.

📊 Markets This Week

📈 FTSE 100: 7,930 (↑2.63%)

🇬🇧 FTSE 250: 19,724 (↑1.08%)

🧾 5-Year Yield: 3.816% (↓5.15%)

💵 GBP/USD: $1.26/GBP (↓1.03%)

🎟️ Unilever: 3,931p (↑2.08%)

⭐️ Sector Roundup

🏘️ Property: It’s SPRING season indeed. Asking house prices sprung for the third consecutive month, up 1.5% — the biggest rise in 10 months. That said, Rightmove reported demand has slowed slightly after a lacklustre Budget.

🏦 Banks: Nationwide filed its final bid to buy Virgin Money for 220p per share, but not everyone’s happy. Analysts think the stock’s fair value is closer to 337p, as the bid places the bank at a price-to-tangible net asset value (TNAV) of 0.65.

🛍️ Retail: Next saw its shares hit an all time high after reporting record profits. With its CEO renowned for his gloomy outlooks, the shift to a more optimistic tone surprised a few and could suggest a brightening outlook for the industry.

🧴 Consumer Goods: Unilever UL 0.00%↑ is spinning off its ice cream division. New CEO Hein Schumacher sees the business as a low-growth, margin-dragger and is attempting to reinvigorate the stock given its flat performance since 2016.

✈️ Airlines: easyJet flew 3.1% after its CEO reiterated the airline’s outlook in an interview. With Euromonitor data forecasting packaged holidays to expand 11% in 2024, easyJet is set to grow “more than any other European airline this summer”.

🛬 Is the Soft Landing All But Confirmed?

Inflation continues to make good progress. February’s data, which saw both the headline and core figures come in 0.1% lighter than consensus was widely celebrated. As CPI is now starting to lap the higher M/M figures we saw over a year ago, it’s worth noting that BOTH headline and core CPI on a 3, 6, and 9-month annualised basis are now below 2% despite the higher M/M jump in February.

As such, if the coming months’ M/M CPI figures can average at c.0.1%, any upside risks from second-round effects (higher minimum wages and pensions in April) may keep CPI below or near the Bank’s 2% target for the rest of 2024. This is our base case — in line with ING and RMS’ forecasts.

This seems achievable given that we’re due for a steep drop in M/M inflation from the lower energy price cap in April, and possibly a sharper one in July, according to ING. This would serve as a massive barrier to keep headline inflation below 2%, as household energy and services make up almost a third of the CPI basket.

Nonetheless, the brightest spot from the CPI report came in the form of the sharp disinflation seen in Restaurants & Hotels, and to a lesser extent, Recreation & Culture — both of which have been the main culprits behind sticky services inflation given their sensitivity to higher labour costs. Therefore, with higher wages to come, a further decline in March may help to offset the upward pressure in April and beyond.

As a result of the encouraging CPI data, the BoE shocked markets on Thursday noon. Interest rates were essentially guaranteed to hold steady at 5.25%, so most of the attention was paid to the committee’s voting patterns. And to the surprise of many, renowned hawks Catherine Mann and Jonathan Haskel (pictured above) pivoted to a hold, having voted for a hike in February, thereby laying the foundations for a rate cut.

Why did the hawks finally give in then? Well, there were two key points as to why this may have been the case. The first clue lies in the meeting minutes (see quote below). The second is the BoE's admission that they overestimated their longer-term CPI projections in February's meeting due to geopolitical factors, although risks remain from higher minimum wages and pensions in April.

“The latest intelligence on average pay settlements collected by the Agents had remained close to the levels observed in the Agents’ annual survey presented in the February Report. (However), Agents’ contacts had generally expected lower pass-through of higher labour costs to prices compared to 2023.”

Having said that, markets rocketed as the FTSE 100 saw one of its biggest weekly gains over the past year (yes, 2.63% is considered massive for this sad index). This is because the odds of a rate cut in June have shot up to approximately 70% from 50%. In fact, there’s even a 10% chance that the BoE could cut in May, after the Bank’s meeting minutes revealed members are now looking at monthly annualised figures.

Nevertheless, we reiterate our initial estimate made in January — 75bps worth of cuts beginning in June. We also anticipate a downward revision to the Bank’s CPI estimates in their next monetary policy report, with inflation remaining below 2% for the rest of 2024. However, we expect the BoE to cite upside risks from a rebounding economy, as well as the uncertain geopolitical landscape in the medium term.

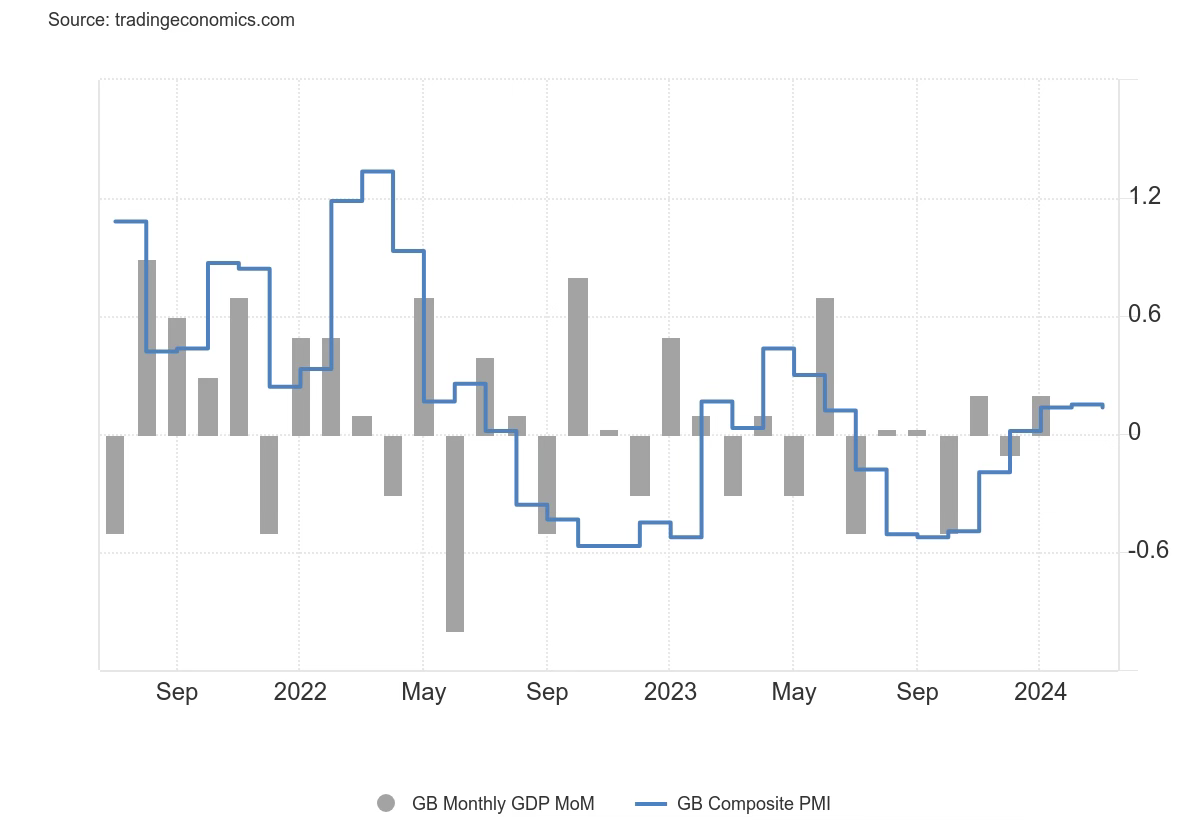

So, does this mean that the UK has achieved the supposed soft landing everyone has been clamouring for? Well, if you discount the 0.3% decline in GDP in Q4 given the ‘robust’ unemployment rate and real wage growth, you could say so. After all, the flash PMI figures for March all but confirm that UK GDP will rebound in Q1 with c.0.3% of growth being priced in by S&P Global.

Meanwhile, despite a stormy February, core retail sales volumes were positive, with January's figures revised upwards, indicating a potential turnaround in the economy. Cost-of-living pressures look to be easing as well, as spending in discretionary items like apparel shot up. And with the GfK personal finance metric hitting a high of +2 since December 2021, it looks like we’ll be entering Spring with a bounce in our step.

❤️ Enjoyed this week’s read? Be sure to click the like button above! Also consider subscribing to get the latest unique insights on the UK economy and the stock market.

🔎 Before You Go… Data Points to Watch Next Week

⛳️ Q4 GDP Growth (Final): With a -0.3% print already baked in from the preliminary figure, Britons will be hoping that the recession isn’t as bad as initially feared, although a worse print could see the rate cut schedule move forward.

🛒 Kantar Grocery Inflation: On Tuesday, we’re expecting Kantar to report yet another decline in grocery price inflation, after February’s fall to 5.3%. Food retail stocks may also be set for a bounce if market share gains continue.