FTSE 100 Sees a Bloodbath 🩸 Sainsbury's Stays Cautious 🚧 Are Housebuilders and Bank Stocks Trading at a Bargain Today? 💸

The FTSE 100 suffered a bloodbath this week, losing 275 points as the UK's main index finished in the red for five consecutive days. Nonetheless, there are still glimmers of hope worth highlighting 🔦

Hello, everyone! 👋🏻 Welcome back to another edition of the Investing Reviews newsletter 🗞️ We’re at the amuse-bouche part of earnings season before the mains arrive in two weeks’ time ✌🏻 Nevertheless, there were still a number of interesting developments surrounding recession indicators, interest rates, and house prices 🏠

🚨 ICYMI — Everything that happened on Investing Reviews this week:

Is the Persimmon share price about to see the roof cave in? 🏚️

With the ASOS share price down 95%, is it time to go shopping? 🛍️

As the BP share price dips, is it time for investors to refuel their portfolios? ⛽️

The BT share price is down 25%! Should investors hang up or hold? 📞

(NEW!) - The challenges of early-stage investing 🎧

FTSE 100 Sees a Bloodbath 🩸

📢 Headline Numbers

🇬🇧 Composite PMI (June): 52.8 🔻

🏭 Manufacturing PMI (June): 46.5 🔻

💅🏻 Services PMI (June): 53.7 🔻

🏗️ Construction PMI (June): 48.9 🔻

🏘️ Halifax Average House Price (June): £285,932 🔻

🧃 Juicy Details

For those unfamiliar with PMI figures and their significance, it tends to be a leading indicator for the health of the UK economy ⛑️ It’s essentially a survey of how companies across various industries are doing 📝 A number above 50 means that businesses are expanding/growing, while a number below 50 means contraction 🔽

On the face of it, June’s figures weren’t pretty, with declines across the board ⬇️ Manufacturing contracted as demand for physical goods continued to slow. Construction work also eased due to residential work seeing its fastest decline in over three years. The accelerated downturn in house building weighed on overall workloads as lower mortgage approvals are beginning to take effect 👷🏻♂️

However, the silver lining lies in the fact that the UK economy is heavily weighted towards services 👨🏻🍳 As such, strong services PMI figures should help to keep the UK economy afloat 🛳️

Even so, investors alike still have to battle with an aura of worry 😣 While input costs in both manufacturing and construction saw their biggest drops in years, costs in services continue to remain an issue. This will most likely add further pressure on core CPI 🔥 Services recorded yet another sharp increase in their average costs thanks to rising wages, offsetting any gains from falling energy and transportation bills 👨🏻💻

For that reason, JPMorgan released a note, stating that the Bank of England could hike interest rates to as high as 7% in order to tame inflation 🤯 As inflation in OECD countries reaches its lowest level since 2021, the UK still stands out like a sore thumb 👍🏻 It’s the only G20 country to have the highest inflation — a catastrophic failure by all means. But Andrew Bailey will continue to blame the weather in Morocco 🇲🇦

🗣️ My Takeaway: Authorities are rather quick to blame supermarkets and other retailers for ‘profiteering’ from the cost-of-living crisis 🫵🏻 And while that might be true to some extent, the same people aren’t looking in the mirror to reflect on how this situation even unfolded 🪞 I bet half the people in government don’t even know how to boil an egg 🥚

Sainsbury's Stays Cautious 🚧

📰 Story of the Week

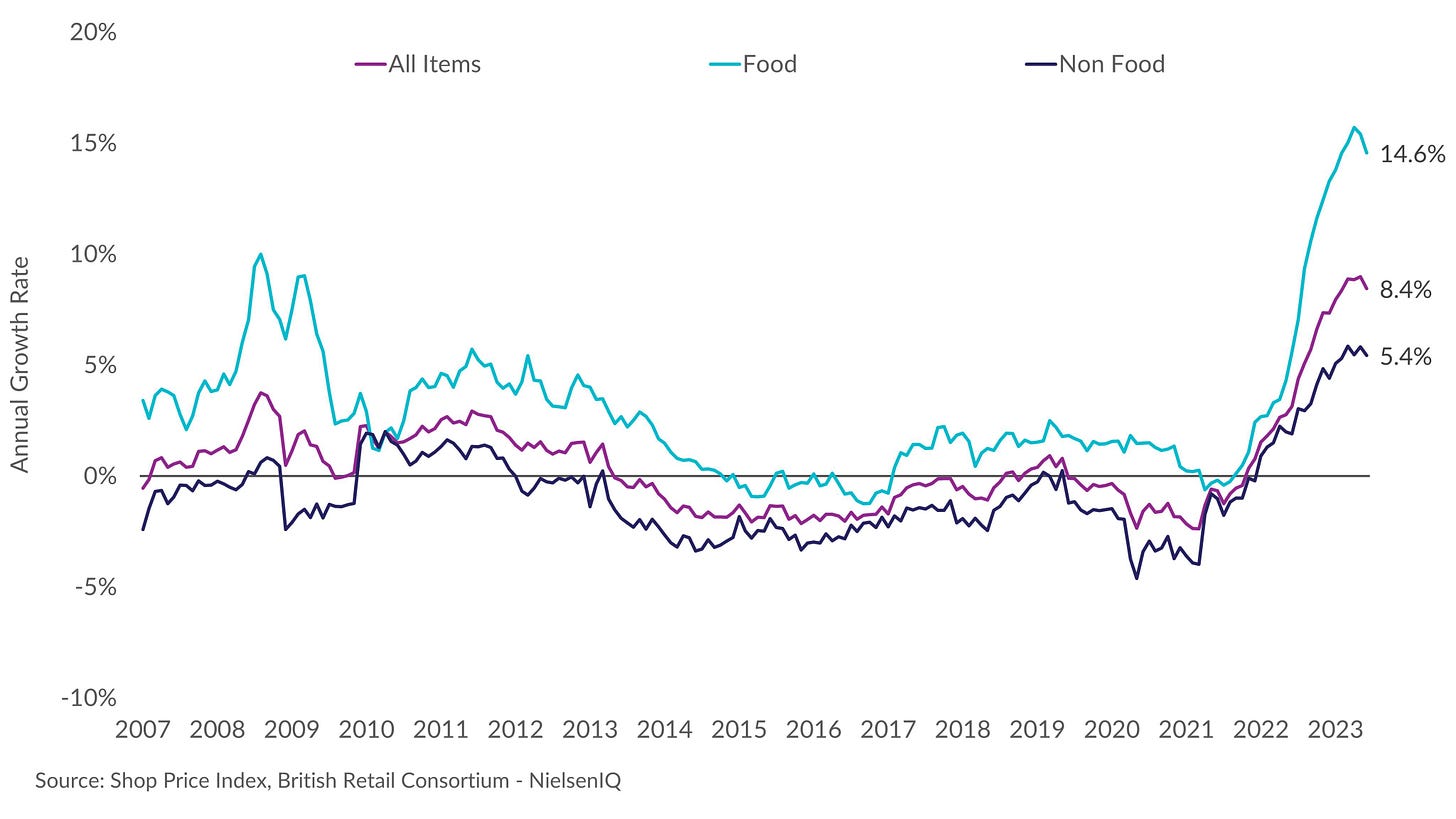

Sainsbury’s reported its Q1 trading update this week, and it was certainly a bright spot for shoppers as food inflation continues to show signs of abating 🍊 The orange grocer has cut prices across more than 120 essentials, with the prices of its top 100 selling products now lower than they were in March, all while the rest of the market continues to see increases 🥕

That said, this has come at a cost to its top line, as like-for-like (LFL) sales only grew by a measly 3.9% 🥲 This pales in comparison to inflation that’s running at a hot 8.7%. But excluding fuel, LFL sales growth actually looked more encouraging at 9.8% 🤞🏻 That’s because shop price inflation averaged at 9% in Q1 🧾 Therefore, the grocer reported volume growth returning for the first time in over two and a half years 👏🏻

Despite that, Sainsbury’s shares still finished the week flat 🫳🏻 This is probably down to the fact that the board left its guidance of flat pre-tax profits for the year unchanged 🔮 That being said, this could be down to the company attempting to maintain a positive image having come under fire for ‘profiteering’ during the cost-of-living crisis by authorities 👨🏻⚖️

🗣️ My Takeaway: Sainsbury’s update serves as a ‘confirmation’ that food inflation is indeed coming down on the retail level. But with wage pressures continuing to remain elevated, it’s unlikely that food prices will return to their pre-Ukraine war levels any time soon, or ever, for that matter 🛒

🔔 Other Earnings Headlines

Persimmon woke up on Thursday and went AWOL with no trading update, leaving investors hitting the refresh button like they were booking Beyoncé tickets 🎟️ It wouldn’t be surprising if it reports gut-wrenching numbers in August 🤮

Currys’ was responsible at least, reporting their full-year results, although horrific ☠️ The retailer reported a statutory loss of £481m due to goodwill impairments, not helped by international sales dropping 73%, while withdrawing dividends 💰

Are Housebuilders and Bank Stocks Trading at a Bargain Today? 💸

🧠 Insight of the Week

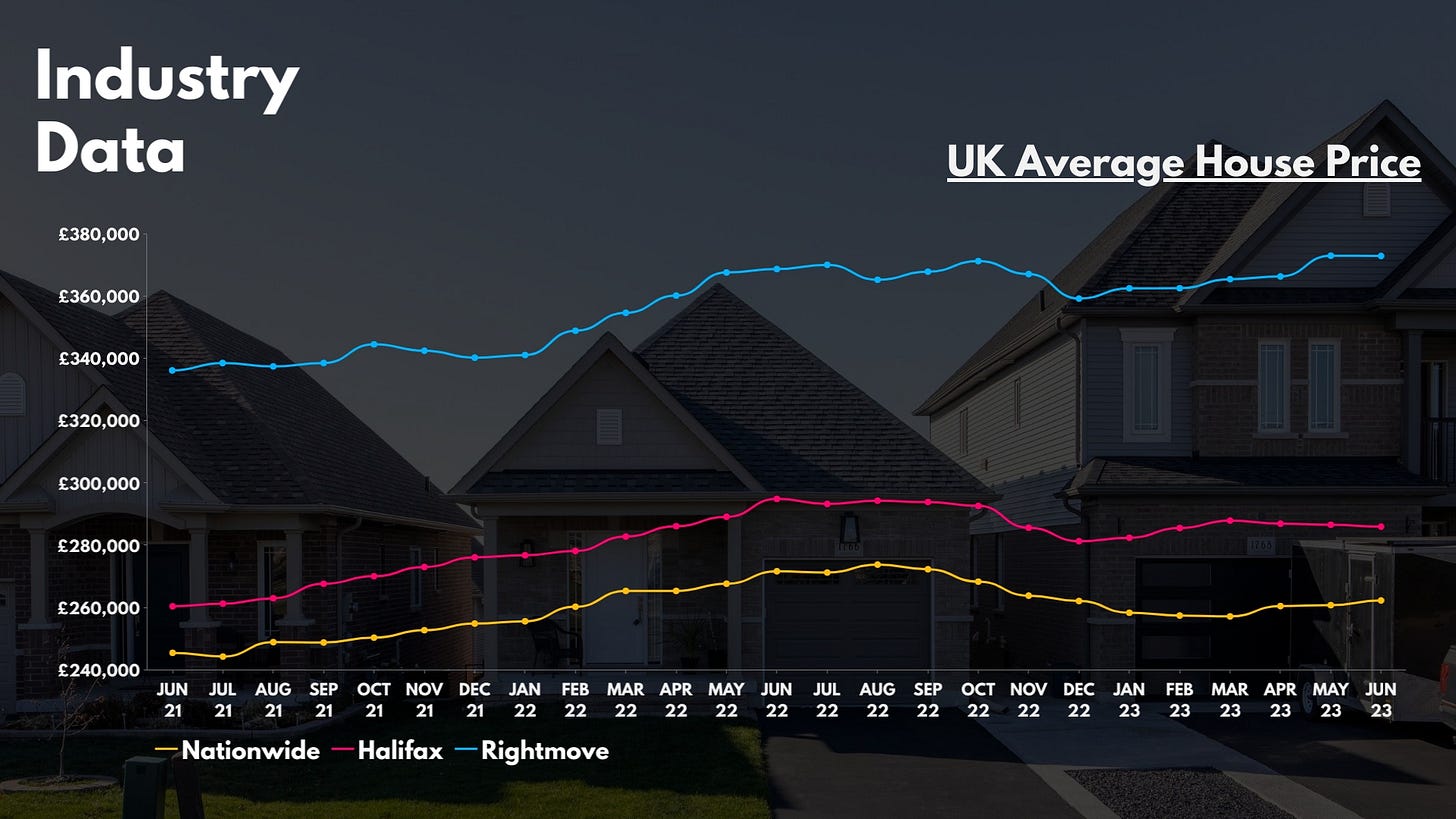

Halifax reported that the average house price declined by a staggering 2.6% in June. And as one can imagine, stocks went into a decline and the media was sent into an uproar ✊🏻 And even though the housing market should still brace for a potential onslaught in the coming months, it’s also equally as important to analyse the recent data beyond the headlines 🔎

So, part of the reason for the painful drop is down to the fact that house prices this year are going up against property values that hit an all-time high last summer ☀️ But what has gone unnoticed by the media, is that the recent trend seems to have stabilised — at least for now anyway ✋🏻 Mortgage applications are holding up well too, particularly from first-time buyers, and new-build house prices continue to rise 🧱

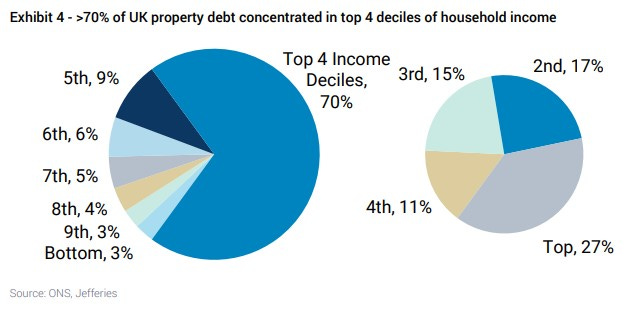

Still, there's always a lagged effect with rate increases, so the worst may be yet to come ⛈️ But despite the bleak outlook, a correction seems more likely than an outright crash at the moment. Unemployment remains at healthy levels, while household savings remain above their pre-pandemic levels. Plus, over 70% of mortgages are held by the UK's top 40% of earners, making defaults less likely 💷

But if inflation continues to remain sticky for the foreseeable future, the rapid tightening of monetary policy could trigger a recession, leading to higher unemployment and a bloodbath in the housing market 🏡

🗣️ My Takeaway: Banks and housebuilders hold impeccable balance sheets today, giving them sufficient capital to weather the storm🌪️ The likes of Lloyds, NatWest, Berkeley, and Taylor Wimpey have more affluent customers with lower LTV loans 🏦 With most of their stocks down c.20%, there could be a buying opportunity for long-term holders as the market seems to be overly pessimistic given the current data 💡

🔦 Elsewhere in the News

Insolvencies surged by 56% as another 1,952 retailers went bust in the year leading up to June. Sounds like bad news, but big retailers have benefitted from less competition and new customers 🤑

Footfall improved on the high street in June, thanks to a combination of excellent summer weather and increased tourism 👒 Perhaps an even better outlook is in the works for retail stocks 🔼

Ofgem warns utility companies not to pay mega dividends without getting their house in order first 🧹 The regulator said that fines could be issued to those paying out dividends if they’re found to be in a “poor financial state” 📄

Ryanair achieved record passenger traffic in June, with 17.4m passengers travelling with the budget carrier. Travel demand doesn’t seem to be going anywhere, so easyJet shares could fly higher later this month 🛫

Dunelm lost 8% after an RBC downgrade, citing “unfavourable movements in the UK housing market and only a moderate store expansion story”. Sainsbury’s also saw ‘Home & Furniture’ sales decline the most amongst its ranges 🪑