🛒 Should You Worry About Supermarket Stocks?

Supermarket stocks may not have had the best start to 2024, but business data is showing otherwise, especially for the three publicly-listed grocers. Does this present buying opportunities?

Hello there! I'm John Choong, Senior Equity Research Analyst at InvestingReviews. Every week, I dissect the latest stock market news, macroeconomic data, and even drop a share tip or two. Join me, as I dig into the financial world's nitty-gritty.

🗞️ This Week’s Highlights

💨 Deflating optimism: Food inflation fell to its lowest level in two years. Meanwhile, Tesco and Sainsbury’s continued to gain market share with M&S. Still, their share prices are down this year after the run they had in 2023.

🛫 Ryanair’s loss is easyJet’s gain: Europe’s biggest budget airline said that it may have to hike prices due to capacity constraints, thanks to Boeing. It should be no surprise then, to have seen easyJet shares continuing to rise this week.

🏡 Wimpy guidance not showing true prospects: Despite beating estimates on its bottom line, Taylor Wimpey shares saw a selloff post-earnings as it gave lacklustre guidance — but don’t be fooled.

📊 Markets This Week

📈 FTSE 100: 7,710 (↓0.27%)

🇬🇧 FTSE 250: 19,341 (↑0.78%)

🧾 5-Year Yield: 3.932% (↑1.63%)

💵 GBP/USD: $1.27/GBP (↓0.17%)

🎟️ Taylor Wimpey: 140p (↓4.11%)

💨 Deflating optimism

Supermarket stocks haven’t had the best time thus far in 2024. After enjoying what was a rather prosperous 2023, food retailers have seen their share prices drop this year. Fears of potential food deflation, higher costs, and the paring of rapid gains last year have seen the share prices of Tesco (LON:TSCO), Sainsbury’s (LON:SBRY), Marks and Spencer (LON:MKS), and Ocado (LON:OCDO) tumble.

This is in contrast to reality, however, as the outlook for the food industry, is picking back up. This week, both BRC and Kantar reported further falls in shop price and food inflation. Both of which will be good news for CPI and consumer confidence moving forward.

What’s more, the three public-listed supermarkets (Ocado’s more of a tech company anyway), have been doing particularly well. The latest report from Kantar showed that Tesco continued to gain market share, as has Sainsbury’s with its ever-growing range of Nectar Prices. Consequently, the big two saw their market shares grow by 0.3% and 0.4%, respectively, building on their excellent performances last year.

Marks and Spencer continues to punch above its weight too. In an eventful week for grocers alike, M&S was voted the best supermarket for a third year running by customer review website, Which?.

So, given all these positive developments, why are supermarket shares getting dropped then? Well, one prevailing theme that’s spooking investors is deflation. Some might mistake the recent cooling of inflation as prices declining, but it actually means that prices are just increasing at a slower rate. Deflation, on the other hand, means prices ACTUALLY declining — and that’s not good for supermarkets.

This is because falling prices may force supermarkets into price wars and heavy promotions to compete for customers (which we’re already seeing to an extent). This would then shrink their already-thin profit margins and impact their earnings. In fact, the often-cited FAO food price index, which serves as a leading indicator for food inflation, is already in deflation territory.

This is why JPMorgan is bearish on the sector, as they’re projecting lower margins and profits moving forward for the reasons stated above. They also think that with not much more market share up for grabs from losers (eg. Asda and Morrisons), customer acquisition will be hard to come by in 2024, leading to flat/lower volumes.

That being said, we disagree with this assessment. With real incomes estimated to continue trending positive, rebounding consumer confidence, and lower inflation, we expect robust spending power to fuel volume growth and offset lower prices — most specifically at supermarkets which offer good value. This has been evident in the recent trading updates posted by Tesco, JS, and M&S.

Nonetheless, deflation still remains a possibility, especially if volumes aren’t strong enough to offset lower prices. That said, we hold the view that industry players will continue to price reasonably. With higher wages and energy hedges coming into/still in play, we see a barrier to further declines to prices in the near term.

More importantly, it’s also worth noting that a substantial number of players are still loss-making and/or heavily in debt (eg. Lidl and Asda). As such, lowering prices to a point of further losses for the sake of customer acquisition isn’t economically viable, and is why we remain bullish on the sector. We retain our Buy ratings for Tesco and M&S, with a Hold on Sainsbury’s.

🛫 Ryanair’s loss is easyJet’s gain

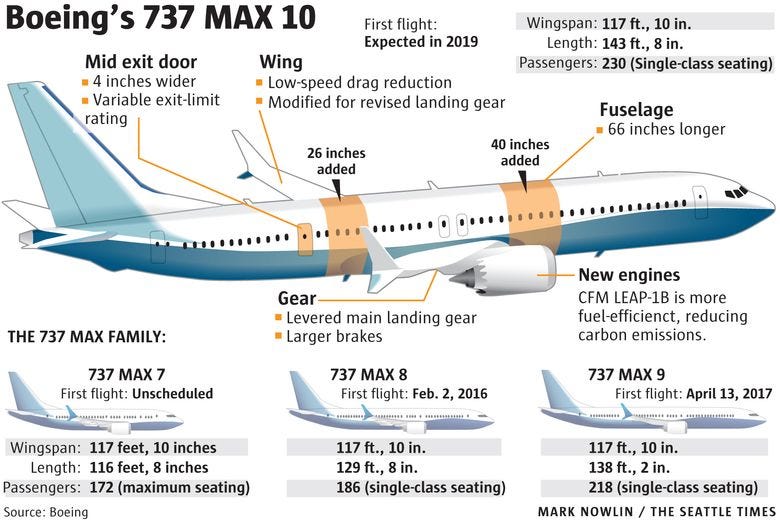

Prior to the recent debacle surrounding Boeing’s BA 0.00%↑ B737 MAX9 flown by Alaska Air ALK 0.00%↑, there were already concerns about the airplane manufacturer hitting its production targets. Thus, recent investigations into the company have only made things worse, as production timelines have been pushed back further.

This is starting to have a profound impact across the Atlantic — mainly on Ryanair RYAAY 0.00%↑ who is heavily reliant on the type. Numerous probes into Boeing are now acting as spanners in the works, as factories can no longer operate as efficiently, leading to delays to produce Boeing’s flagship plane, the B737.

Despite the MAX 9 not being on the order book of Europe’s largest airline, it doesn’t change the fact that Boeing still uses the same factories to manufacture such aircraft, as any differences between Ryanair’s MAX 10s and the infamous MAX 9s are minimal.

As a consequence, CEO Michael O’Leary expressed his displeasure this week, after receiving news that his airline will only be receiving 40 out of an expected 57 deliveries this summer.

“We’ve been very firm with the view it’s inexcusable… Our growth has been constrained because at this point in time we don’t really know how many aircraft we are going to get… There is a shit show going on in Seattle (Boeing’s main production line).”

With travel demand showing no signs of cooling (quite the opposite, in fact), you can perfectly understand why O’Leary is feeling so riled up about this. Summer is usually a peak period for travel, and the last thing he wants is to lose out on customers from a lack of seats available or price hikes. The latter of which could put customers off from flying Ryanair when prices are already incredibly competitive in the budget space.

But unlike Ryanair, easyJet runs a full-Airbus fleet that has been immune from the recent issues Boeing has had. Unlike its American counterpart, Airbus has not only been more reliable in manufacturing aircraft over the years, it’s also delivered aircraft to easyJet ahead of schedule.

Additionally, easyJet’s Airbus fleet runs on CFM engines, rather than P&W, which have also resulted in the partial grounding of Wizz’s (LON:WIZZ) fleet. Therefore, this positions easyJet to be in the perfect circumstances to snatch market share from its budget competitors this year. This is also why the newly-inducted FTSE 100 flyer has seen its share price outperform its European peers in 2024.

Having said that, here’s where easyJet could win customers. Ryanair may be the giant monster in this market. But with its tummy already filled to the brim with passengers, its aircraft might not be able to accommodate more customers. In the latest quarter, Ryanair’s flights were 92% full, whereas easyJet has slightly more capacity at 86%. This gives the latter more room to accommodate more passengers.

Combined with the fact that easyJet is also anticipating more deliveries this year from Airbus and the potential to gain customers (albeit not grand by any means) from both Ryanair and Wizz, and we see a potential upgrade to FY23 earnings when CEO Johan Lundgren next discloses the firm’s interim results. For that reason, we reiterate our Buy rating on the stock.

🏡 Wimpy guidance not showing true prospects

Taylor Wimpey (LON:TW) didn’t have the best week despite reporting results that were mostly in line with estimates, with a marginal beat on its bottom line. It even posted an increase in its dividend, something the market wasn’t pricing in. Good news then? Not so much. Investors reacted poorly on the back of the earnings release as the guidance provided disappointed.

On the back of achieving a higher-than-expected number of completions in 2023, CEO Jennie Daly let investors down with her outlook. Despite the tick up in sales rates over the past couple of months as mortgage rates decline from their peaks, Daly still doesn’t think it’s enough to even match last year’s completions. Rather, she guided for completions of 9,500 to 10,000 homes.

However, unless supply constraints are an issue, we see upside to the housebuilder’s outlook, and think that Daly is following what I like to call the Machin model — underpromising and overdelivering. We believe as cancellation rates subside and the order book fills up, there’s potential for completions to come in closer to FY23 levels, weighted towards the latter half of the year.

As interest rates are set to drop, albeit slowly, markets will undoubtedly begin pricing in lower rates which will push mortgage rates back down. This should in turn stimulate demand — even more so when consumers’ balance sheets are improving thanks to positive real wages and lower price-to-earnings ratios. With build-cost inflation projected to return to 0% for the year, operating margin should recover as well.

Still, analysts aren’t convinced, downgrading their EPS and sales outlooks for 2024. Nevertheless, we’re not so concerned whether these gloomy predictions come to fruition or not. Rather, it’s the medium and long term prospects that excite us, with EPS expected to grow by c.46% by 2026, with room for upgrades as interest rates drop.

Regardless, we think that Taylor Wimpey and the big five housebuilders in general are well-positioned to capitalise on a sector that has unprecedented demand. But what makes Taylor Wimpey one of our preferred picks is its stable dividend policy. Investors are ‘assured’, at the very least, to get a return of 7.5% of the conglomerate’s net assets or £250m in dividends every year.

*It should be noted that dividend policies can be retracted at any time.

Paired with the fact that the developer isn’t as heavily reliant on first-time buyers and has a more affluent customer base, and it’s safer to say that its profits won’t be as heavily affected as its cheaper peers either, thus giving investors less volatility. It’s for these reasons that we issue a Buy rating on Taylor Wimpey with a price target of 165p.

💡 Why follow John’s share tips?

Rated as the #1 analyst by Stockomendation, John Choong has outperformed the UK stock market. Moreover, his insights are often cited in renowned publications such as the Financial Times, Bloomberg, Yahoo Finance, and many more.

🔎 What to Watch Next Week

📕 Spring Budget: Arguably the most pivotal event of the year. Tax cuts are on the agenda, but other reforms such as a potential (but unlikely) cut to stamp duty on UK shares, larger allowances for ISAs, and even the scrapping of the tourist tax, could give long-neglected UK shares a much-needed lift. And who knows, as crazy as it sounds, 99% LTV mortgages might even be thrown in the works.

🛒 BRC Retail Sales Monitor: After this week’s BRC data showed that retail inflation continued to cool to 2.5%, next week’s retail sales print will give further insights as to whether the industry is set for a bounce back. The bar isn’t set high, with consensus estimates of 1.5%. But a figure closer to 2.5% would mean that volumes are becoming less negative and heading in the right direction.

📑 S&P Services PMI: The catch 22 of the week. Markets are pricing in another relatively strong print of 54.3, showing that the UK’s heavily-weighted services economy continues to expand at a healthy pace. A higher-than-expected print will likely mean that the UK is already out of its recession, but it could also mean that the Bank of England is likely to interest rates higher for longer.

🏗️ S&P Construction PMI: Markets are still expecting the construction sector to have remained in construction territory in February, but there’s some optimism that the print on Wednesday will be a fourth consecutive month of rebounds — a first since April 2022. The key metric to look out for will be house building, as a figure above 44.2 would indicate brightening prospects for the depressed sector.

🏘️ Halifax House Price Index: Will the recent rebound in house prices continue? That’s the question on everyone’s minds. Last week’s Nationwide data suggests so. And with mortgage approvals data picking up, so should the quality of data. Recent trends would indicate that house prices should remain positive, with markets looking for year-on-year growth of 2.3%.