🪩 Better Times are Coming

Markets were in a jubilant mood as they shrugged off last week's Blue Monday. Recession fears are getting curbed, as a week of positive data had investors dancing to the tune of tax cuts.

Hello there, I'm John Choong. Every week, I dig into the financial world's nitty-gritty with three in-depth segments. Here, I spill the beans on the latest macroeconomic data, news, and even offer a share tip or two. Join me as I dissect this week’s drama.

🗞️ This Week’s Highlights

🕺🏻 Jiggle to ‘wiggle room’: ‘Tax cuts’ — everyone’s favourite two words, at least for the most of us. You’ll be hearing a lot more of that in the weeks to come, as the latest borrowing figures have given the government more room to cut taxes.

☕️ Were recession fears a storm in a teacup?: Whether we entered a technical recession or not in Q4, doesn’t seem to matter at this point. The UK has started the year on the front foot, as early data forecasts a 0.2% expansion in Q1.

✈️ Easy money with easyJet?: Boeing’s loss is easyJet’s gain. Europe’s second largest budget airline has had a flying start to its year, with its latest Q1 update lifting its shares higher — and it’s still no where near expensive.

📊 Markets This Week

📉 FTSE 100: 7,644 (↑2.44%)

🇬🇧 FTSE 250: 19,343 (↑2.50%)

🧾 5-Year Yield: 3.775% (↑1.04%)

💵 GBP/USD: $1.27/GBP (↑0.12%)

🎟️ easyJet: 532p (↑7.35%)

🕺🏻 Jiggle to ‘wiggle room’

Get your jiggle on, because better times are coming. Bar another bout of price shocks from geopolitical tensions, there’s plenty to feel optimistic about in 2024, and this week's data shows just why.

You’ll have seen it all over the news this week, but the term ‘wiggle room’ has been thrown all over the place. The latest borrowing figures came in much better than expected (£6.85bn vs £14.70bn) in December. But how did this happen? Well, c.20% of government debt is linked to CPI. Therefore, lower inflation has eased the interest the government needs to pay, meaning it can borrow less to repay bondholders.

As a result, this gives Chancellor Jeremy Hunt — you guessed it, wiggle room — to buy votes issue tax cuts in March. Investors alike were quick to rejoice, but several concerns remain, and the most prominent one I read on LinkedIn this week was:

“These (tax cuts) are counterintuitive. The UK economy isn't exactly healthy. It's flatlining, and there's even a chance of a potential recession in the near future. If that happens, the government might have to open the borrowing taps again to give the economy a boost."

This concern is valid, though — the UK (especially the government) is certainly in no position to celebrate, especially given how terrible growth has been over the past year and a half. We might've skimmed a technical recession, but is it really counterintuitive? Maybe not, and here’s why:

Lower government borrowing leads to…

More room for tax cuts leads to…

More discretionary income leads to…

More spending leads to…

Economic growth…

Resulting in less of a need for the government to ‘open the borrowing taps’ to stimulate the economy.

Nonetheless, the fear here stems from the possibility that tax cuts may not be enough to stimulate the economy and tax revenue for the government to pay its debt. But here’s the good news — inflation is forecast to hit c.2% in April. This should continue to drive down borrowing costs, as a lower amount of money will be required to cover interest.

Yet, the answer isn’t so much in borrowing, but rather in spending. If the UK wants to get its debt under control over the longer term, it’ll have to take a more disciplined approach in what it decides to spend on, and how much.

And if Hunt is as serious as he says he is about wanting to jolt life back into a stagnating stock market, investors will need to see a higher risk premium for stocks. In simpler terms, investors need a reason to pick stocks over bonds. This will be difficult to do if debt-to-GDP remains at record high levels. That’s because the higher the risk of the government defaulting on its debt, the higher the bond yields.

☕️ Were recession fears a storm in a teacup?

Throw the baby out of the bathwater because the recession is over before it even started. It seems like any recession fears were short-lived, because it’s all kicking off in Q1.

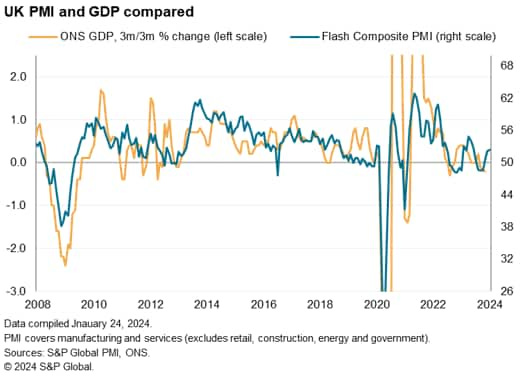

The latest preliminary services PMI figures came in at an eight-month high of 52.5, beating estimates of 53.2. Given that c.80% of the UK’s economy is comprised of services, S&P Global is now forecasting UK GDP to grow by 0.2% in Q1 — on track for the second-highest reading since Q1’22.

*PMIs are business surveys that are often used as leading indicators for economic growth. A figure above 50 signals a growing economy, and a figure below 50 suggests a potential recession.

The positive read bodes well for Britain’s economic outlook. However, it also pushes back the possibility of early rate cuts, hence the bathwater idiom. Still, if one had to decide between early rate cuts but a recession with high unemployment, or later rate cuts but no recession, a sensible person would take the latter.

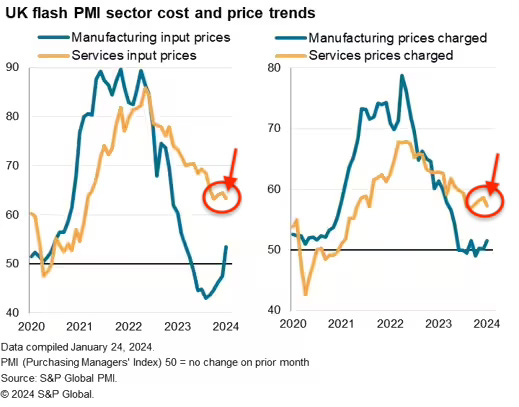

But what does this mean for inflation? Considering the stickiness of services inflation, surely an uptick in services activity won’t do core CPI any good? Well, not exactly. Like I mentioned last week, “the devil will be in the details” — and it was.

The headline print came in hot, but this was mostly attributed to new business growth and international exports of services. Notice how prices weren’t mentioned. That’s because the key point to highlight here is that while there were further increases in input prices, the rate of increase was the lowest in three months. Consequently, this drove output charges to rise the least since October.

As a result, there was more optimism over stronger client demand, long-term business investment plans, and an improved economic backdrop. All of this lifted service firms’ sentiment in January. Combined with another uptick in the most recent GfK consumer confidence read (-19 from -22), and there’s an increasing amount of room for an optimistic outlook for 2024.

January’s cut in national insurance, falling mortgage rates, and rising real wages will all do the economy the world of good as consumers feel better about their finances. In fact, consumer expectations posted the first positive reading in two years. In conclusion, good news for inflation and the economy — at least for now.

✈️ This Week’s Share Tip: easyJet

It's utter chaos right now in the airline industry, and even more so in the short-haul market. Especially for those running Boeing 737 aircraft (MAXs or not), customer perception is a MASSIVE factor and cannot be discounted. No matter how 'safe' airlines claim their 737s to be, recent events can develop into fear and hesitation when deciding which airline to fly with.

With Ryanair running an all-Boeing fleet and even expressing concerns about the manufacturer’s quality control, it could lead to a drop off in flyers for the Irish airline. So, who's to potentially gain from this? Look no further than easyJet (LON:EZJ), as the orange airline runs a full Airbus fleet.

As such, they're likely to be more immune to the current bout of 'panic' amongst flyers given Airbus' much better safety track record. Winning is exactly what they’ve been doing too. Whilst disruptions to the Middle East set the company back by £40m in Q1, easyJet smashed expectations with yet another record quarter:

Not only did top line revenue come in better than expected, the firm’s bottom line also improved despite CEO Johan Lundgren’s warning of stagnant year-on-year progress on H1 losses, when he last spoke to shareholders. As a consequence of good cost management and better unit economics, the FTSE 250 stalwart is now projecting H1 losses to reduce from last year.

This massive improvement can be attributed to the shift in its winter capacity, as Lundgren & co. opted to focus more on destinations with higher growth (beach and ski towns) during the winter. Moreover, the insourcing of maintenance along with robust fuel hedges has given easyJet headway to reduce its EBITDAR losses massively from a year ago.

But it doesn’t stop there. The jump in ancillary revenue is also worth commending, as it’s a key business within easyJet's model that serves as a margin booster. Higher conversion rates as a result of better offerings has vastly improved non-seat revenue. What’s more, the board is focused on optimising the supply chain to improve margins further, which will likely result in better-quality earnings.

Nevertheless, easyJet’s packaged holidays division is the pivotal point behind our investment case, as we believe this to be the main driver for higher-quality earnings and margins in the medium term. And unsurprisingly, Holidays revenue has effectively more than doubled. This not only shows the rampant amount of demand for such a service, but also easyJet's ability to capitalise on it efficiently.

It is therefore safe to say that easyJet is slowly but surely building an incredible economic moat and investment thesis. The fact that the group has managed to scale its pre-tax profit margin for its Holidays business in such a short span of time whilst maximising efficiencies in its two other business arms is commendable to say the least.

More crucially, reports indicate that travel remains a top priority for household discretionary spending, with 15% planning more getaways in 2024 than in recent years. Thus, easyJet is set to be a beneficiary, and its positive forward bookings should also be an indicator of another bumper year ahead. As the winds continue to blow in the right direction, we reiterate our Buy rating with a price target of 665p.

🔎 What to Watch Next Week

🏠 Mortgage Approvals: Forecasts are currently pricing in a small increase from November’s 50.07k to 51.50k, in line with the positive reports from Nationwide and Halifax in December. In line with this, our base case remains optimistic — mortgage approvals have bottomed out and the housing market will be back this year.

🏘️ Nationwide House Price Index: Current market consensus expects house prices to see further increases in January, with a 0.1% month-on-month increase, and an improved year-on-year figure of -0.2% from -1.8%. If the figure does come in as/better than forecasted, expect housebuilder stocks to jump.

🏦 Bank Rate Decision: The Bank of England reconvenes on Thursday. Nothing out of the ordinary is to be expected, with the Monetary Policy Committee (MPC) likely to hold the bank rate at 5.25%. But it’ll be the language surrounding the outlook on the economy and inflation that will either spook markets or see them rejoice.