❌ The Housing Market Crash is Cancelled

Markets pared some of the gains made last week as a hawkish Bank of England pushed back expectations of an early rate cut. Still, there were pockets of joy, with the housing market being one.

Hello there, I'm John Choong. Every week, I dig into the financial world's nitty-gritty with three in-depth segments. Here, I spill the beans on the latest macroeconomic data, news, and even offer a share tip or two. Join me as I dissect this week’s drama.

🗞️ This Week’s Highlights

💣 Myth busting the doom-mongers: Despite Nationwide posting yet another solid outlook for the housing market in 2024, doom-mongers continue to purport a gloomy narrative. Unfortunately, their claims fall short.

♟️ Andrew Bailey plays 4D chess: As expected, the Bank of England (BoE) stuck to their guns by holding the Bank Rate at 5.25%, and could hold it there until the summer. But here’s why Andrew Bailey could be a hidden genius.

🍑 A fruitful investment?: If the housing market bottom has been realised as we think it has, one of the country’s biggest housebuilders could be stand to benefit over the long term.

📊 Markets This Week

📉 FTSE 100: 7,615 (↓0.26%)

🇬🇧 FTSE 250: 19,171 (↓0.86%)

🧾 5-Year Yield: 3.784% (↑0.16%)

💵 GBP/USD: $1.26/GBP (↓0.56%)

🎟️ Persimmon: 1,450p (↓1.56%)

💣 Myth busting the doom-mongers

Nationwide released its January data this week, which saw house prices rise 0.7% from December, with the year-on-year growth rate improving to -0.2% from -1.8%. To complement this, December’s mortgage approvals were up too. Despite missing estimates slightly, approvals still improved to c.50.5k from c.49.3k in November.

Still, that didn’t stop certain doom-mongers from purporting more gloom, as they continued to cite low volumes leading to unreliable data. Some even dug up December's non-seasonally adjusted mortgage approvals as evidence that the housing market will still crash “slide” by 30%. Funny how language can shift so quickly when the narrative isn’t quite going your way.

At first glance, the non-seasonally adjusted figure looks terrible, and those who aren’t overly familiar with statistics will easily buy the fear. After all, c.36.2k is a MASSIVE drop from November's c.50.1k, and lower than the 2015-2019 December average of c.48.4k. However, this completely misses the point and highlights why seasonally-adjusted figures are needed.

A drop off happens in December because consumers are busy buying gifts, not houses. What’s more, it’s a shorter month due to the holiday season, with banks and brokers shut for almost 25% of the month. Therefore, seasonally-adjusted measures are required to omit volatility in the dataset on a monthly basis. In fact, the opposite occurs during the summer, so if it’s all the same to you, it balances itself out.

But even on a non-seasonally adjusted basis, the hypothesis still falls short when looking at the numbers on a deeper level. That’s because the drop rate between November and December in 2023 was actually the lowest since 2014 (ex. pandemic years). This is even more ‘impressive’ when considering the fact that November’s figure is much lower versus the historical average.

*For instance, if there were 2 fewer houses sold in December from 10 in November, that would constitute a drop rate of 20%. But if there were 2 fewer houses sold in December from say, 100 in November, that would only constitute a drop rate of 2%.*

Further disproving the doom-and-gloom narrative, activity is also picking back up. Both the latest Rightmove index and RICS house price balance indicated an uptick in enquiries, interest, and activity. This only makes sense considering the mortgage price war that has been going on over the past couple of months, with the latest data from the BoE acknowledging the first benchmark rate drop since November 2021.

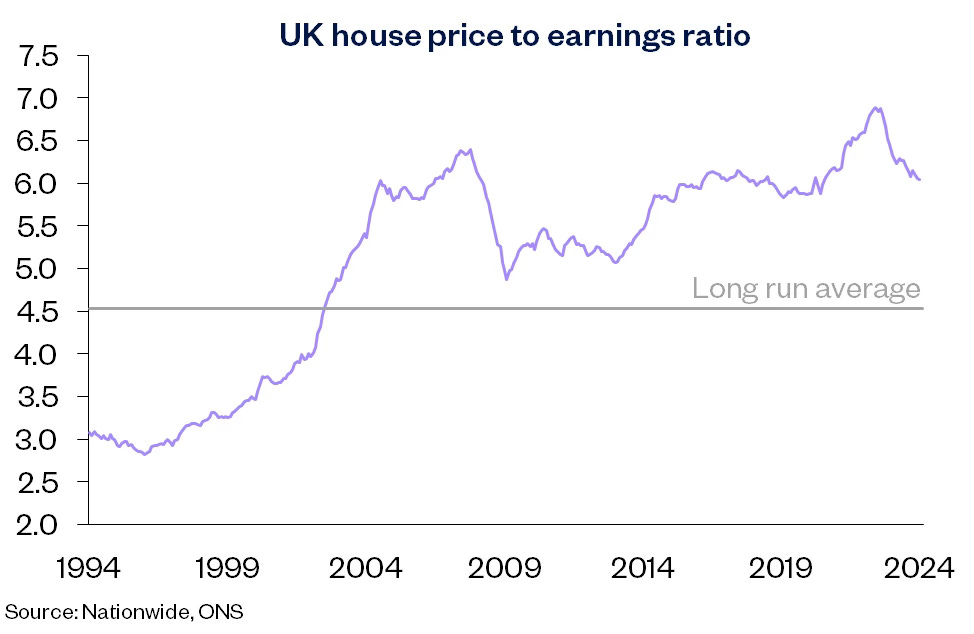

But don’t pop the champagne just yet. Things are getting better, but by no means are they amazing — in fact, not anywhere near. Stagnant house prices and positive real wage growth have certainly helped affordability, but challenges remain in order to drive sustainable, long-term growth in the housing market that benefits both buyers and owners alike.

The current macroeconomic environment is undoubtedly volatile, and the uncertainty surrounding when the BoE will begin cutting rates, and by how much has cooled the mortgage price war. As a matter of fact, Nationwide themselves even raised rates this week. And if house prices are to rise again, the lender thinks much lower rates are needed.

“Other things equal, mortgage rates of 3% (still well above the lows seen in the wake of the pandemic) would be needed to bring this measure of affordability back towards its long run average.”

Nonetheless, it’s important to remember that nothing ever travels in a straight line. Rates will come down, and it’s a matter of when and not if. But if there’s one take away from this, it’s that the housing market isn't going to crash by 30%. Bar a black swan event, the doom-mongers are full of themselves; the bottom is in.

♟️ Andrew Bailey plays 4D chess

For the first time since 2008, the Monetary Policy Committee (MPC) had a three-way split in their votes — Catherine Mann and Jonathan Haskel voted to hike by another 25bps, Swati Dhingra voted for a 25bps cut, while the others opted to hold rates steady at 5.25%. Whilst Governor Andrew Bailey didn’t exclusively rule out an early rate cut, he and his peers continued to assert the infamous line:

“The MPC judged that monetary policy would need to remain restrictive for sufficiently long to return inflation to the 2% target sustainably in the medium term, in line with the MPC’s remit.”

Nevertheless, this hasn’t stopped certain segments of the market to believe rate cuts can come as soon as May or even March. The rationale for this is that headline inflation will hit the Bank’s 2% target by March/April and that should be enough to warrant cuts — but that’s shortsighted, in my opinion. As much as I’d love to see a rate cut sooner rather than later, a cut before the summer is becoming less likely.

I say this because the economy will have to contend with higher wages and pensions in April. This will undoubtedly lift the cost base of businesses, and those costs will most likely be passed down to consumers in the form of higher prices, thereby stoking inflation. Meanwhile, the higher disposable income from pensioners will likely end up fuelling more demand, and won’t help to cool inflation by any means.

When combining the above with sticky core inflation, and the depleting drag from lower energy and food prices in the latter half of the year, CPI will likely hover above the 2% mark. Thus, it’s no surprise to see Andrew Bailey continue to talk hawkish — though he might also be playing 4D chess. Bloomberg’s John Stepek thinks I’m being too generous to assume the BoE to be this intelligent, but here’s my theory anyway:

UK is a net importer, so a strong currency is required to quell inflation from making imports cheaper.

Bailey continues to talk hawkish, keeping GBP strong.

Latest US jobs data shows a hot labour market, so Fed rate cuts may be pared back.

BoE will have to cut after the Fed to avoid GBP losing value, especially against the USD.

Either way, the Bank is forecasting CPI in January, to tick up again, to 4.1% from 4.0%. Although this might look discouraging, I must point out that the Bank has been missing its inflation estimates like a drunk throwing darts. It underestimated CPI on its way up, and now it’s overestimating on its way down. But the silver lining here is that, this leaves more room for a dovish pivot, rather than a hawkish one moving forward.

Even so, several economists are still wary of another upward surprise in January. Most prominently, renowned economist Simon French is projecting headline CPI to come in as high as 4.3%! The reason for this is because services inflation is likely to come in higher due to weaker base effects (AKA, much lower prices last January) — remember that CPI is measured year-on-year (Y/Y).

That said, I'm not so sure myself. I'm no economist, but the latest British Retail Consortium (BRC) shop inflation data paints an optimistic 'forecast' for inflation this month. Although not perfect historically, it's interesting to note that non-food inflation (NFI) has been a pretty decent leading indicator for CPI since June 2022. In other words, that was the last time CPI went up when NFI declined.

Combined with this January's lower energy price cap from last January’s peak, I'm expecting the sharp decline to offset the increase in services inflation. As a result, I'd imagine headline CPI to remain stagnant at 4.0%, at the very least. Current consensus see CPI at 4.3%, but I’m betting it comes in at 3.8%. But for the sake of our money (and hearts), let’s hope the print comes in lower on Valentine’s Day.

🍑 This Week’s Share Tip: Persimmon

I wasn’t off by much last year when I predicted that house prices were going to slide by less than 10% in nominal terms, and I’m feeling more optimistic about the housing market this year. As crazy as it sounds, and it might even contradict current consensus, I see house prices rising by as much as 5% on a Y/Y basis by the end of the year, with most of the growth backloaded in the latter half of 2024.

So, who’s to benefit from this then? Well, there are numerous housebuilders, but I’m going for Persimmon (LON:PSN). The residential developer’s shares rose from the ashes in Q4’23, up 51% from their 5-year low in October. Additionally, they continued to build on those year-end gains with a stronger-than-expected trading update:

At first glance, the numbers don’t make for pretty viewing. High interest rates and the removal of the government’s Help to Buy scheme decimated completions by a staggering c.31%. In spite of that, the company’s results still came in much better than consensus estimates, and even higher than our much rosier forecasts.

It’s for this reason that we think Persimmon has realised peak pain, with more upside to come in the medium term. Short-term volatility should be expected due to the uncertainty surrounding the timing of rate cuts. But given the increasing disparity between supply and demand in the UK’s housing market, we see Persimmon as one of, if not, the best name to capitalise on favourable long-term demand.

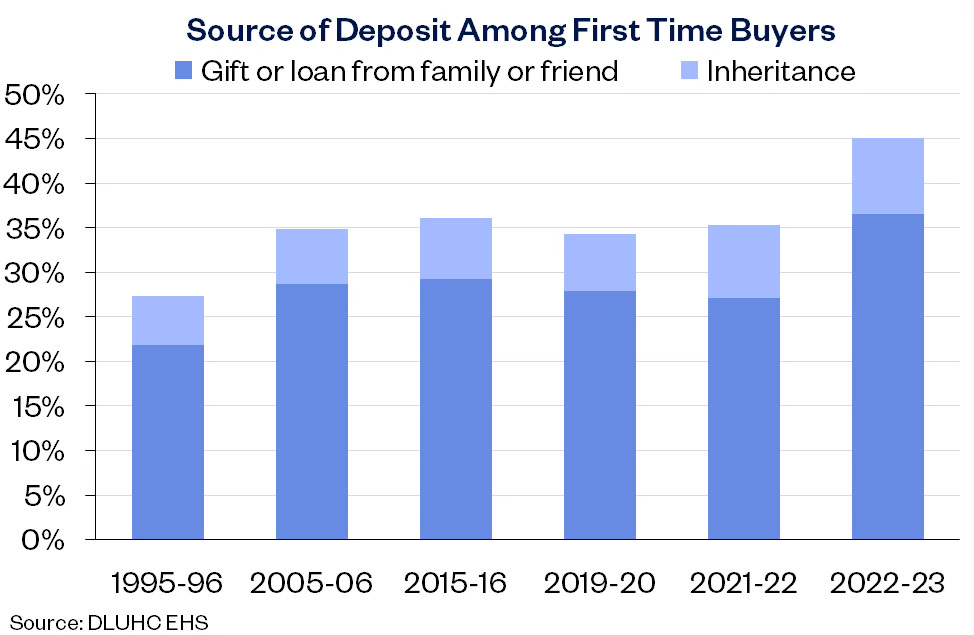

According to Nationwide, the percentage of first-time buyers receiving financial aid to secure a deposit has increased to 45% from 34% before the pandemic. This is something Persimmon can capitalise on given its much lower average selling price versus its peers. Especially in an environment where affordability remains low, we believe the firm has fertile grounds to build on this unique value proposition.

Moreover, the group’s land bank remains one of the biggest amongst its peers. With outlets ready to scale and build in 2024, we can see a scenario where Persimmon even takes market share this year, especially from those with insufficient land. This should see completions rebound along with its order book, as rates come down towards the latter half of 2024.

Be that as it may, what makes Persimmon our top pick is its promising long-term margin expansion story, which we envision to be industry leading. Persimmon is a volume builder, so the lack of volumes in FY23 contributed to the huge drop off in margins. But as volumes return and build-cost inflation subsides, we see a favourable and brighter outlook for the FTSE 100 returnee in FY24 and beyond.

This will be in part thanks to the conglomerate’s vertical integration efforts, which will streamline its supply chain in the medium term. Acquisitions such as Brickworks (in-house brick production), Space4 (timber frames), and TopHat (modular house builder) will give Persimmon the ability to build houses quicker and more efficiently, thereby presenting the opportunity for massive margin expansion.

Aside from that, the housebuilder also boasts a flawless balance sheet with literally zero debt. This means that investors won’t have to worry about hefty financial obligations in this current period of high interest. This should therefore pave a smoother runway for earnings to lift off, with the potential to even boost dividends back to their previous highs.

Of course, risks are ever present. A black swan event could very easily spark a rapid reversal in mortgage rates and sink the share price once again as orders and sales deplete. But taking the likelihood of this into consideration and a resilient British economy with positive earnings growth and strong employment, we continue to affirm our investment case for Persimmon with a Buy rating and a price target of 1590p.

Why follow John’s share tips?

Rated as the #1 tipster by Stockomendation, John Choong boasts a remarkable 66% average hit rate and a 12.4% average annual return, outperforming the long-term stock market average. In addition to that, his insights and comments are often cited in renowned financial publications such as the Financial Times, Bloomberg, Yahoo Finance, and many more.

🔎 What to Watch Next Week

📑 S&P Services PMI: Flash estimates came in higher than expected at 53.8, and is what the market is expecting for the final print. Despite that, Investors alike will be paying most attention to prices and wages in the report, with any confirmation of the downward trend likely to spark some relief. But any surprise to the upside could stoke fears that services inflation will remain sticky.

🛍️ BRC Retail Sales Monitor: A stormy January isn’t likely to produce any uplift in retail sales. Markets are pricing in a growth rate of 1.7% from last year, but it’s worth noting that this figure isn’t adjusted for inflation, meaning that volumes largely remain negative. That being said, a figure above estimates could pump some love back into retail stocks after their hefty falls this year.

🏘️ Halifax House Price Index: Everyone except doom-mongers will hope that Halifax confirms Nationwide’s encouraging trend, in that house prices continue to recover. The Y/Y estimate is for house prices to grow by 1.9% from 1.7% in December, with a M/M growth rate of 0.2%.

🔑 RICS House Price Balance: Another key survey for those in residential property to pay attention to. Markets are expecting a further improvement in the balance to -26% from -30%. Plus, any further shortening in the average length of time to complete a sale will be welcomed.